Non-governmental organizations (NGO’s) in Cyprus

Copyright 2022 Christiana Aristidou LLC

The meaning of non-governmental organizations (NGO’s)

The term non-governmental organizations, abbreviated as NGO’s, usually defines a group or body of volunteers that functions independently of any government. They are sometimes called civil society organizations, and are established with a vision to offer at community, in national, or international levels, and aspire to serve a humanitarian purpose or the protection of the environment.

The current legal regime of incorporating and maintaining NGO’s in Cyprus: The different vehicles

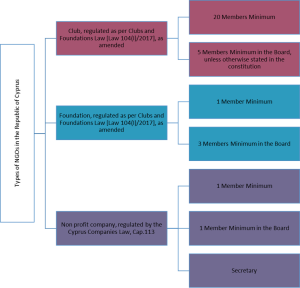

There are currently three options for establishing an NGO in the Republic of Cyprus. These are Clubs and Foundations, and are regulated by the Clubs and Foundations Law (Law (104(I)/2017), as amended. (The last amendment occurred in 2020). As regards the third option, that is the incorporation of a non-profit company in the form of a private company limited by guarantee, as per the Cyprus Companies Law, Cap. 113.

Provided that either of the above vehicles is granted approval by the Council of Ministers of the Republic of Cyprus for its treatment as a ‘charitable organization’, the income of such an organization of public interest is exempted from taxation. According to the provisions of the Law on Income Tax (Law 118(I)/2002), donations to such approved charitable organizations may be eligible and qualify for the deduction for tax purposes. Nonetheless, whether the donors may be able to deduct such amount of donation(s) paid as charities to the approved charitable organizations, is a tax matter that needs to be examined as per the relevant tax laws of the jurisdictions from which donation(s) is (are) coming from.

Main differences between the three vehicles: Characteristics and obligations

Registration of a Club as per the Clubs and Foundations Law [Law 104(I)/201], as amended.

- A Club needs at least 20 members to start with. These members will be members of the Club and members of the Board.

- A Club must have at least 20 members that sign the incorporation documents.

- The Club is governed by the Law and its constitutional documents.

- A Club serves public purposes and must not have a commercial or economic purpose.

- It is also important to note that any movable or immovable property given before or after the formation of the Club belongs to the Club and not to the donors or members. In case of dissolution of the Club, the property is not distributed to the members.

- The management of the Club is undertaken by the Board of Directors which must be composed of at least 5 members unless otherwise stated in the constitution of the Club.

- The decisions are taken with a simple majority of the present members of the Board of Directors unless otherwise stated in the constitution of the Club.

- The Club must prepare and file audited accounts every year with the Registrar of Clubs, which is under the responsibility of the Ministry of Interior.

- The registering authority for Clubs is the Registrar of Clubs, in the Ministry of Interior

- Certain mandatory notifications need to be made to the Minister within the first three months of each calendar year. These concern the number of members added or deleted to the Club, changes to the Board Members or their addresses, and confirmation that the minimum number of general meetings have taken place, as per the constitution of the Club

- It normally takes 1 to 3 months to register a Club, from the date of filing all the required documents.

Registration of a Foundation under the Clubs and Foundations Law [Law 104(I)/2017 ], as amended.

- A Foundation is managed by 3 or more persons and, unless the constitution provides otherwise, their decisions are taken by a simple majority of the members present and, in case of a tie, the vote of the president prevails.

- A Foundation is established for the purpose to manage for non-profit purposes a dedicated property or an asset that is donated to the Foundation. More specifically, the founder(s) is(are) liable to transfer the allocated property from the outset of the incorporation of the foundation.

- A Foundation has to register (in the respective Register) its Act of Incorporation containing its name, purpose, seat and allocated property as well as the names and addresses of the members of its management.

- The value of the said property must not be less than € 1,000.

- The administration of the Foundation can be taken over by Commissioners or the Board of Directors appointed by the founder or founders. The manner of their succession must be specified in the articles of association (constitution) and after the Foundation has been established it must be clear to the founders that they, themselves, cannot subsequently change the Commissioners or the Board of Directors.

- According to the Law, the objects of a Foundation can be the promotion of education, the promotion of health, promoting citizen and community development, the promotion of the arts, culture, cultural heritage or science, the promotion of amateur sports, the promotion of human rights, the settlement of disputes or reconciliation, or the promotion of religious or national harmony or equality and individuality, promoting the protection or improvement of the environment, alleviating the needs arising from the young or old age, health problems, disability, financial difficulties or other handicap and promoting animal welfare and protection.

- The members of the Foundation are obliged to keep accounting records, in which all transactions of the Foundation are recorded, and are also obliged to care for the preparation and submission before the relevant Ministry, of audited accounts at the end of each financial year.

- The registering authority for Foundation is the Registrar of Foundations in the Ministry of Interior.

- It normally takes 1 to 3 months to register a Club, from the date of filing all the required documents.

Registration of a non-profit company under the Companies Law, Cap 113

- Non-profit companies in the form of a private company limited by guarantee, are established and registered under the Companies Law, Cap 113.

- The registration, regulation and operation of a private company limited by guarantee (registered as a non-profitable organization) fall under the provisions of the Companies Law, Cap. 113.

- The private company limited by shares, differs from a private company limited by guarantee, in the liability of the shareholders (members in the case of a private company limited by guarantee) of each type of company. The liability of the shareholders of a private company limited by shares is limited by the company’s Memorandum to the amount, if any, unpaid on the shares respectively held by each of the shareholders. Companies limited by guarantee ‘provide’ limited liability to their members; in the sense that, the liability of the members of such a company is limited to the undertaking of contributing (an amount respective to the amount each of the members guaranteed) to the company’s assets in case the company is wound up.

- No minimum quota that a member is obliged to guarantee. But, previous members of the company may also be liable to contribute to the company’s assets upon the winding up of the latter but such an obligation of an old member extends only to the amount of it guaranteed and for debts incurred while it was a member in the company.

- The objects of the company to be incorporated must relate to the promotion of commerce, art, science, religion, charity or any other community interest purpose.

- The company’s profits, and revenues must be used for the promotion of the company’s objects

- Company must prohibit the distribution of dividends to its members. The company’s memorandum of association (constitution) must explicitly state the non-profit purpose for which the company is established.

- The company’s memorandum of association must explicitly state that in the event of the company’s dissolution, any surpluses shall be distributed exclusively to non-profit community interest organisations, with objects similar and/or comparable to the objects of the company under dissolution.

- Α non-profit company is managed by the Board of Directors.

- A non-profit company must file audited accounts with the Registrar of Companies every year.

- The registering authority for a private company limited by guarantee is the Department of Registrar of Companies.

- The time to register a non-profit company is around 2 weeks.

Below you will find a diagram, which includes the main differences between the three vehicles.

Disclaimers

This Note is for general information only, it is not comprehensive, and does not constitute legal advice; please do not rely on this without obtaining professional services.

All information in this Note is strictly confidential and is intended solely for its addressees. Any dissemination, disclosure, copying, distribution to any other person or review or use by any other person, except the addressee is strictly prohibited. All information is subject to review and may be amended upon the passing of reasonable time.